What is multi-currency payment processing?

Multi-currency payment processing is the processing of payments in different currencies. The economy continues to globalize, and supply chains grow ever more complex.

Businesses may be forced to source more goods and services from international partners, which may require adopting payment processing that supports international payments to address security concerns and fully reduce delays.

Although the pandemic brought the first-ever decline in global payments in 2020, McKinsey & Company reports that growth has returned to this market sector and is expected to reach $2.5 trillion by 2025 1.

So, regardless of where a business stands currently, they can expect the need for multi-currency payment support to increase for their customers and suppliers.

1 McKinsey & Company. 2021. Global Banking Practice: The 2021 McKinsey Global Payments Report.

How do companies make multi-currency payments?

Often companies make multi-currency payments by using a currency exchange service or banking institution to facilitate the conversion of one currency to another.

This may be a more complicated process than determining the exchange rate. The exchange rate always fluctuates; however, other factors complicate matters further.

Taxes and fees are other factors that make multi-currency transactions complex. Suppose a company is actively expanding into a foreign market. In that case, there may be a high volume of transactions to manage, which can take additional time and energy from accounts payable staff.

Companies do well to invest in a platform that can handle domestic and international payments to streamline their workload.

Foreign exchange payment challenges

Consider some of the challenges companies face when they take on international payments to suppliers and customers.

Exchange rate changes

There is no global currency or common standard to determine every exchange rate. To make matters worse, every country’s market is subject to its discrete market forces.

There are also different methods for calculating the rates of exchange. This dizzying complexity may cause some businesses to withdraw from accepting foreign currency payments or limit their interaction with international suppliers.

This can create real issues for businesses as they scramble to find a domestic supplier. They must catch up to their competitors, who have already discovered a solution to multi-currency payment processing.

Payment processing

Payment processing for multi-currency transactions can be quite complex. The process becomes even more complicated as more countries and currencies are supported.

Intermediary organizations such as financial institutions and third-party auditors mean extra fees may be assessed. Longer payment cycles may also arise as the process gets more intricate.

All these factors can also strain the relationship between the payer and payee if the multi-currency payment process needs to be handled more fluidly.

Hidden fees and charges

One method of addressing the constant flux of exchange rates is a daily calculated exchange rate determined by a banking institution. This can include a markup to limit their risk of fluctuations during the day.

AP teams working with real-time exchange rates instead of marked-up daily rates can realize measurable benefits.

Compliance requirements

Many countries have laws regarding funds that cross international borders. Companies must be aware of taxes and fees to remain compliant and avoid penalties or legal troubles.

Reporting requirements and record-keeping measures may need to be followed so that accounts can be audited properly.

Cultural and language differences

International payments may face challenges that could be more technical. Because multi-currency payments happen between businesses or individuals from different backgrounds or cultures, the risk of misunderstandings is greater.

Companies must maintain good relations with international partners and may require that they build out their internal infrastructure to support this activity.

This may include additional customer relations, legal, marketing, and sales staff that can conduct business in other languages and observe necessary cultural norms from the target market.

Manual vs. automated multi-currency payment processing

Multi-currency payments can be handled by accounts payable staff through a manual process, which is how business has always been conducted.

But manual processes tend to be slow and labor-intensive, and there is a greater risk of human error and payment cycle time delays in an already complex process.

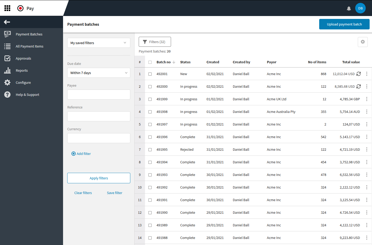

An automated AP system that supports multi-currency payments alongside domestic ones creates a more streamlined workflow.

One payment method is used, which provides a consistent process across every transaction rather than separate paths for complicated international payments.

Frequently asked questions about multi-currency payment processing

The benefits of using multi-currency payment processing software are a game changer for businesses. While many traditional payment gateways may support multi-currency, they often charge exorbitant conversion fees.

An in-house method of supporting multi-currency transactions reduces fees and offers a better service to suppliers and customers. It also improves security and partnership relationships.

Multi-payment processing software works much the same as a traditional payment processing gateway by providing functionality to convert between local currencies and target currencies.

The system allows for real-time conversion of transaction amounts rather than relying on a potentially out-of-date daily rate with an additional markup for safety.

Selecting a system that supports the key currencies you conduct business in is important to receive the full benefits of smoother payments and full automation. Otherwise, multi-currency payments may cause exceptions and create the need for manual intervention by AP staff.

Any business that conducts transactions internationally can benefit from multi-currency payment processing software. When the solution chosen features automation of common tasks, it helps to simplify the process and take much of the guesswork out of the AP team’s hands.

As globalization of the market continues to increase due to technological advances, supply chain diversification, and other factors, more and more businesses will need to answer how they will support multi-currency payments.

There may be good reasons to pay vendors in their local currency. Certainly, it can foster better vendor relationships by paying them in their preferred methods.

Accounts receivable teams with supplier companies may have an easier time matching your payment with their invoices.

But there may be other practical reasons for making payments in a foreign currency. Additional fees may be assessed, or a higher exchange rate must be followed when not paying in local currency.

The chance of fraud may also be higher if a company does not handle the currency conversion itself.

Cross-border payments involve making payments to vendors or accepting payments from customers from different countries.

These transactions may have more challenges than domestic ones, including the need to support multiple currencies, additional fees, and the risk of fraud.

The globalization of the market and the rise of readily available technologies means that more and more businesses must consider the subject of cross-border payments.

For example, digital mobile wallet usage in e-commerce is expected to reach 52% market saturation in 2023, according to Worldpay, which will only increase cross-border commerce opportunities.

Foreign exchange services allow end consumers to convert their money into a target nation's currency to purchase goods and services. These rely on a knowledge of the current exchange rate.

Companies may need to convert capital to other currencies too. The global foreign exchange between banks is handled under the direction of the Bank for International Settlements.

Sometimes, a business may transact with suppliers and customers in multiple markets. Multi-currency payment support can allow goods and services to be purchased and sold in many different currencies simultaneously.

Powerful and intelligent AP automation software like Medius can easily integrate with your existing enterprise resource planning (ERP) software.

This means that AP staff can continue to use the tools they are familiar with while having access to real-time and accurate data.

The Medius solution to this need is to build integrations ready to connect to your other business systems and provide synchronizations through REST APIs.