Did your supplier change banks or are you getting robbed?

Organized crime groups and bad actors are becoming far more specialized, professional, and advanced making invoice fraud easier to master and harder to stop.

- 13 cases of attempted invoice fraud in the past 12 months

- 9 cases of successful invoice fraud in the past 12 months

- $133,000 annual cost per company

Who’s stealing from you and how?

53% of finance professionals admit that they have been targeted by attempted deepfake scamming attacks.

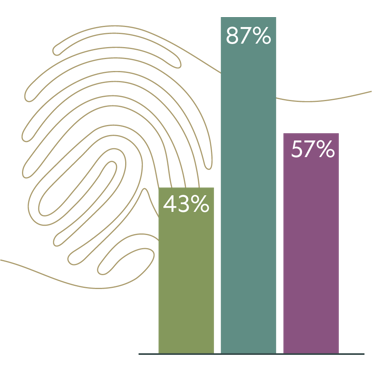

- 43% admit they have ultimately fallen victim to a deepfake attack

- 87% admitted that they would make a payment if they were “called” by their CEO or CFO to do so

- 57% of financial professionals can independently make financial transactions without additional approval

Could internal fraud be the issue?

More than half of financial professionals in the UK and US (56%) have spotted or suspected internal fraud in their workplaces.

- 4 out of 5 have stayed silent

- 45% fear recrimination if they speak up

- 48% said the legal system simply does not adequately protect whistleblowers

This isn't fun anymore.

The majority of financial professionals are unhappy with their roles.

- 71% of finance professionals in the UK are looking for a new job

- 58% of finance professionals in the US are looking for a new job

- On average, 30% of invoices require manual intervention from the finance team

- More than half (55%) said they are burnt out

Want to know more? Read our eBook.

A picture of the challenges facing finance teams: rising fraud, deepfakes, whistleblowing, and retaining talent and how teams can overcome them.