How AP Automation is filling the talent gap from the great resignation

The corporate landscape has been fundamentally altered by a wave of voluntary departures known as the Great Resignation. Industries across the board have felt the impact, but finance departments have been particularly hard-hit. These critical teams, once the bedrock of organizational stability, are now navigating a challenging new reality marked by significant talent shortages. In the midst of this upheaval, Accounts Payable (AP) automation has risen as a vital solution. It stands as a pillar of strength, not only filling the gaps left by a dwindling workforce but also providing a strategic defense against the heightened operational risks and inefficiencies that often accompany such widespread turnover. By leveraging the power of automation, companies are finding innovative ways to maintain continuity, optimize performance, and prepare for a future where adaptability is key.

The Great Resignation: A closer look at the finance sector

The finance sector has traditionally thrived on the back of a skilled and stable workforce, but the Great Resignation has precipitated a talent crisis of unprecedented scale. As finance professionals reassess their career priorities, organizations are facing a talent gap that threatens to disrupt the very core of financial operations. The Medius Financial Census underscores this trend, highlighting a significant shift in the workforce dynamics within the finance industry.

Shifting workforce dynamics

The finance sector's stability is being tested as employees seek more than just a paycheck. Factors such as work-life balance, job satisfaction, and competitive compensation are now at the forefront of their concerns. As a result, finance departments are experiencing a talent drain, with seasoned professionals leaving in search of better opportunities. This shift is not just about numbers; it's about the loss of institutional knowledge and expertise that can significantly hamper a department's functionality and strategic output.

Impact on remaining staff and operations

The departure of key finance personnel leaves a heavy burden on the shoulders of the remaining staff. The increased workload can lead to burnout, a drop in morale, and a higher propensity for errors — all of which can culminate in a slowdown of financial operations. The pressure to maintain the same level of service with fewer resources can also stifle innovation and reduce the capacity for strategic financial planning, further compounding the challenges faced by these departments.

AP automation to the rescue

In the face of the Great Resignation's challenges, AP automation has emerged as a critical technological ally. By taking over the repetitive and time-consuming tasks, AP automation solutions are providing much-needed support to the strained finance departments, ensuring that essential financial operations do not just continue, but thrive.

Automating routine tasks

AP automation's ability to handle routine tasks such as invoice processing, data entry, and payment reconciliations is invaluable. These systems work tirelessly, processing transactions with precision and consistency, freeing up human resources to focus on more complex and strategic activities. This automation not only compensates for the reduced headcount but also elevates the role of the finance team members who remain.

Ensuring business continuity

The true value of AP automation becomes apparent in its ability to ensure business continuity in turbulent times. By providing a reliable and consistent process for managing payables, these systems help finance departments avoid the pitfalls of delayed payments, compliance issues, and disrupted cash flow. Automation thus acts as a safeguard, protecting the business from the financial risks associated with staff turnover and talent shortages.

Operational benefits of AP automation during talent shortages

The operational benefits of AP automation become particularly pronounced during periods of talent shortages. As the finance sector contends with the impact of the Great Resignation, AP automation stands out as a critical enabler of efficiency and effectiveness, allowing teams to maintain, and even enhance, their productivity in the face of reduced staffing levels.

- Streamlining workflows

AP automation introduces a level of workflow efficiency that is transformative. By streamlining the entire accounts payable process, from invoice capture to payment execution, automation reduces the need for manual intervention. This streamlining effect not only compensates for the lack of human resources but also creates a more agile and responsive finance operation that can adapt to changing business needs with ease. - Minimizing human error

One of the most significant operational benefits of AP automation is the reduction of human error. Manual processes are inherently prone to mistakes, especially when teams are overworked and understaffed. Automation brings a high degree of accuracy to transaction processing, ensuring that payments are made correctly and on time, which is crucial for maintaining supplier relationships and financial integrity.

Strategic advantages of AP automation in talent management

Beyond its operational benefits, AP automation offers strategic advantages that extend into the realm of talent management. In an era where finance professionals are seeking more meaningful and engaging work, AP automation can be the key to not only retaining existing talent but also attracting new and skilled professionals to the organization.

Enhancing job satisfaction

By automating mundane and repetitive tasks, AP automation allows finance professionals to focus on high-value activities that are more strategic and intellectually satisfying. This shift can lead to increased job satisfaction and engagement, making the finance department a more attractive place for ambitious professionals looking to make a significant impact in their roles.

Attracting top talent

In the competitive landscape of talent acquisition, the presence of AP automation can be a differentiator. Prospective employees are often attracted to companies that invest in technology and offer opportunities to work on challenging, high-level tasks. By showcasing a commitment to innovation and efficiency, businesses can position themselves as forward-thinking employers that top talent will gravitate towards.

Implementing AP automation: Steps to success

The implementation of AP automation is a strategic initiative that can significantly mitigate the talent gap issues exacerbated by the Great Resignation. However, to realize its full potential, organizations must approach its deployment methodically. The following step-by-step guide outlines the key stages in implementing AP automation, ensuring a smooth transition that aligns with the company's broader talent and operational strategies.

Begin by conducting a thorough assessment of your current AP processes to identify areas that would benefit most from automation. Set clear objectives for what you want to achieve with AP automation, whether it's reducing processing times, cutting costs, or improving accuracy. These goals will guide your decision-making throughout the implementation process.

With objectives in hand, evaluate different AP automation platforms. Look for solutions that offer the specific features you need, such as electronic invoicing, payment automation, and real-time reporting. Consider the platform's compatibility with your existing systems and its ability to scale with your business.

Choose a provider that not only offers a robust platform but also understands the challenges of the Great Resignation. The right partner should provide strong support during and after implementation, including training resources and responsive customer service.

Implementing new technology will require change within your organization. Develop a change management plan that includes communication strategies, training programs, and support structures to help your team adapt to the new system.

Before rolling out the automation solution across the entire organization, conduct a pilot program. Select a small, controlled group to use the system, gather feedback, and make necessary adjustments. This approach helps to identify potential issues before they affect the entire AP process.

Invest in comprehensive training for your team to ensure they are confident in using the new system. Offer ongoing support and resources to address any questions or challenges that arise. Remember, the success of automation depends on the people using it.

After implementation, continuously monitor the performance of the AP automation system. Use the insights gained to optimize workflows and improve efficiency. Regularly review the system against your set objectives to ensure it meets the evolving needs of your business.

Finally, measure the impact of AP automation on your business. Look at key performance indicators like processing times, cost savings, and error rates. Use this data to refine your processes and, when ready, scale up the automation to cover more of your AP operations.

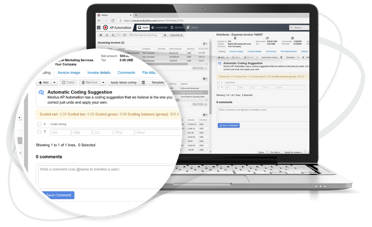

Discover the Medius edge in AP automation

In the wake of the Great Resignation, Medius provides a robust AP automation solution that not only fills the talent gap but propels your finance department into the future. Our intuitive platform streamlines your accounts payable process, enabling your team to focus on strategic financial management rather than mundane tasks. With Medius, you gain the agility to adapt to workforce fluctuations and maintain operational excellence.