How AI is improving risk management in accounts payable

Artificial intelligence has been helping businesses improve processes, performance and efficiencies for decades, but the boom of mainstream AI is officially here. According to a PwC survey, 73 percent of US companies have already adopted AI in some areas of their business, with generative AI (GenAI) leading the way.

For finance teams, specifically accounts payable, AI is breaking the boundaries of possibilities and tackling some key challenges for business – one of which is risk management.

Managing financial transactions requires precision, vigilance and security. It’s always been the case, but the ability of organizations to detect subtle anomalies and mitigate risks has taken a quantum leap forward. Let’s look at why and how AI improves risk management in the accounts payable process.

Why is AI important for AP risk management?

The accounts payable process involves acquiring and managing a lot of financial data, transactions and invoices from suppliers, vendors and customers. The complexity of information can be overwhelming and even the smallest anomalies can have significant consequences. Old-school, manual auditing methods are not suitable for handling the sheer volume and complexity of financial data. Simply put, manual processes would put data at high risk for most businesses. But with AI, you can feel more confident in your risk management.

AI is a game changer for risk management for AP

The machine learning algorithms in AI can understand patterns, learn from historical data and adapt to evolving scenarios in mere seconds – tasks that would take humans much, much longer. This is crucial for catching even the most subtle anomalies that would otherwise go unnoticed by human auditors and more conventional methods.

Sifting through massive data sets

A primary reason AI is so vital is the ability to sift through massive amounts of data at high speed. This includes analyzing countless invoices, receipts and financial documents for accounts payable. The rate at which AI can process data is beyond human capacity and can spot irregularities and potential risks much faster, ultimately saving you time and money. Plus, AI can look at multiple data sets and scenarios to identify risk. Compare that to traditional risk management systems, which rely on predefined rules, and AI’s capabilities become even more impressive. When it reviews data holistically, AI can spot unusual trends, outliers, or patterns that might indicate fraudulent activities, compliance issues or other errors. This is music to AP managers' ears.

Continuous machine learning and improvement for risk assessment

Machine learning, a subset of AI, is essential for accounts payable risk management. These particular algorithms can learn from historical data, which means they are constantly taking in data and understanding what is normal and what is not within the business’s financial system. This means that the accuracy of catching things like duplicate invoices, unauthorized transactions or other suspicious activity is constantly improving. The accuracy improves when it gets smarter, and the risk decreases. For incidences of fraud, this is a big deal.

In fact, research shows that 25% of finance professionals cannot estimate how much fraud is costing them—because they’re often unaware that it’s happening—but the other 75% put the cost at well over a quarter of a million dollars annually. And the rates of fraud attacks keep growing. Knowing you are protected with the extra eyes and ears of AI can ease your fears and your team’s burdens.

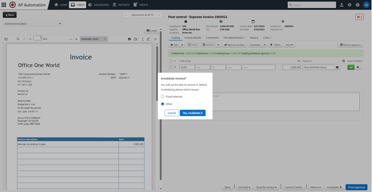

Practical applications of AI in AP risk management

So, it's good to know that AI systems strengthen the AP process and process a lot of data quickly, but what does that mean in real-world accounts payable applications?

Here are a few ways AI plays a role in accounts payable risk management:

- Fraud detection

Fraud is a big area of concern for financial management teams. It’s a growing threat and can take many forms, including invoice fraud, check fraud, vendor fraud and more. Understanding best practices in fraud detection is important – most notably, leveraging tools with AI that can safeguard your data. Machine learning models can detect anomalies in invoice amounts, unusual payment patterns, or discrepancies in vendor details that may suggest fraudulent activities. What’s most important is that many tools, like Medius Fraud & Risk Detection, can often detect fraud the moment irregular data shows up in a system. That’s a risk worth mitigating.

Disorganized crime

Messy paper trails and manual processes make invoice fraud easy.

Organized crime—yes, that organized crime—is becoming more professional, and along with a few rogue individuals, is thriving on disorganized invoice processes.

- Invoice anomaly, duplicate payments and more

Automation is a core component of AI, and AI automates so much— including (but not limited to) invoice review and anomaly detection. So, it can catch duplicate invoices, mismatched data and duplicate payments by analyzing historical data and giving real-time alerts. The machine learning models can even recognize patterns to stop duplicates before they even happen –helping you avoid costly errors and save time for your AP team. - Early payment predictions

AI can also help with risk management by predicting the chances of early payment defaults. It analyzes factors like vendor performance, financial stability and market conditions to provide insights into potential risks. With these insights, you can take proactive measures and stay ahead of the game. - Compliance and reporting

Adhering to industry regulations and internal policies is crucial in AP, and yes, AI can help there, too. By automating compliance checks, you can avoid penalties, legal trouble and damage to our reputation – all things businesses want to avoid. AI also generates detailed reports for making smart decisions and audits. With continuous monitoring, you can automate compliance checks and keep AP processes in line, reducing the risk of violations and penalties. For example, AI can spot invoices that don't meet tax regulations or are missing required documentation. - Real-time monitoring and alerts

According to surveys by Ardent Partners and Cybersecurity Research, more than half of organizations have seen an increase in fraud attempts in the past year. Finance teams are the most common targets.

The good news? With real-time monitoring of financial transactions, organizations can respond quickly to emerging risks. You can set up automated alerts to notify financial teams about suspicious activities or deviations from the norm. This proactive approach helps businesses like yours tackle potential issues head-on, preventing financial losses and keeping accounts payable processes intact.

How to implement AP software with risk management features

You already know risk management is an important part of accounts payable. You are likely familiar with many challenges with the massive amounts of data your team sees, but how do you ensure you can get the best from your AP risk management AI features?

Start by knowing what’s available and invest in a solution leading the way in accounts payable automation and risk management. It’s an investment that keeps on giving.